Español

United States

Health Insurance / Insurance Solutions

What is the Difference between Critical Illness Insurance and Health Insurance?

February 17, 2025

Estimated Reading Time: 4m

Getty Images

Chances are, you’ve been hearing more about critical illness insurance lately—in part because more people are receiving critical illness diagnoses. That said, you may not have a clear idea of what critical illness insurance truly is and exactly how it works.

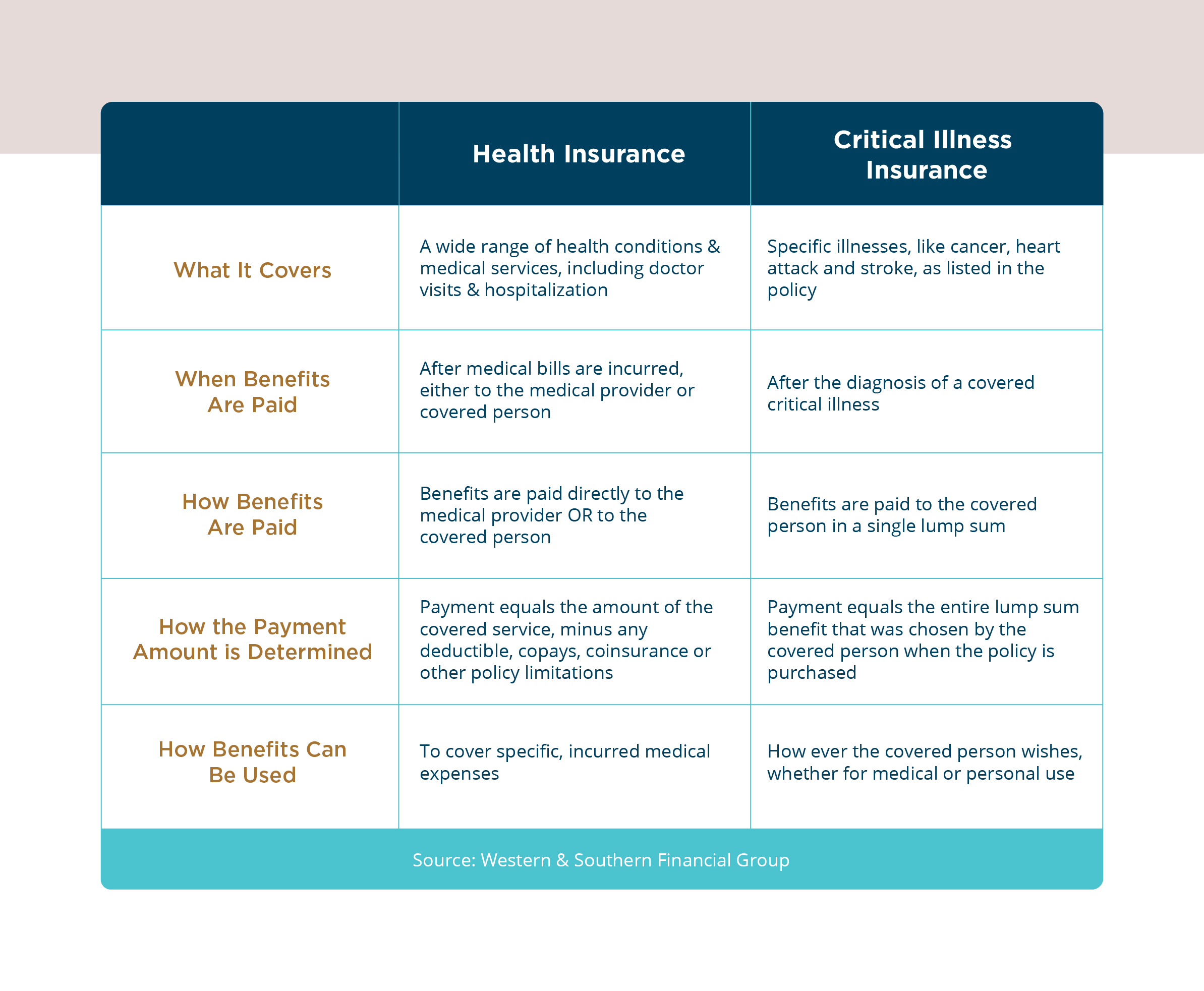

Many people assume, mistakenly, that it’s a form of health insurance. It’s true that both types of insurance pay benefits when a covered person gets sick and/or receives healthcare. But they work very differently, and one is not a substitute for the other.

In a nutshell, here’s what you should know.

What Health Insurance Covers

Most health insurance plans cover a wide range of medical care services: doctor visits, hospitalizations, diagnostic tests, prescription drugs. Many plans even cover preventive care, such as physicals and routine screenings.

Health insurance pays for covered medical services after you receive them. Sometimes, providers are paid directly. Other times, you’ll be reimbursed after you’ve paid the bill.

Health insurance pays exactly the amount that is owed, subject to plan deductibles, copays and coinsurance. And it continues to pay benefits over time as you seek additional care.

What Critical Illness Insurance Covers

Critical illness insurance is very different in terms of what it covers and how benefits are paid.

As the name implies, critical illness insurance covers certain serious conditions, as specified in each policy. While the specific diseases vary by policy (and where you live), they typically cover conditions like cancer, stroke, heart attack, and renal failure.

Critical illness insurance doesn’t cover specific medical services or bills. When you purchase a policy, you select a lump sum benefit—say, $100,000. There are no deductibles, copays or coinsurance.

In the event that you’re diagnosed with one of the covered conditions, your insurance company pays you the lump sum directly, in a single payout.

How Benefits May Be Used

With health insurance, benefits are paid to cover your already‑incurred medical expenses Period.

With critical illness insurance, you can use your lump sum benefit any way you choose—whether to pay medical bills not covered by your health insurance or to help pay everyday household expenses.

For example, if you’re unable to work because of your illness, you can use your benefits to help replace that lost income, rather like disability insurance. In this regard, critical illness benefits are more flexible than health insurance benefits.

How They Work Together

Critical illness insurance isn’t a substitute for health insurance, but it is a valuable, affordable complement to it. Here’s some reasons you might want to buy a policy:

- If you have a limited or high‑deductible health plan, because it will supplement your coverage in the event you need more extensive care.

- If you aren’t eligible for disability insurance, perhaps because you’re self‑employed or are a stay‑at‑home parent.

- If you have a family history of certain health conditions, such as heart attacks and Alzheimer’s disease. It’s an economical way to protect yourself against your higher risk—and you can use those funds to pay for, say, experimental treatments not yet covered by your insurer.

How to Make the Right Insurance Decision

When it comes to insurance, it’s always helpful to talk to an expert who is willing to share their knowledge. Your local PALIG agent can help you identify what coverage(s) are the best choice in your particular situation.

At PALIG, we offer a range of affordable individual and group health insurance plans in many countries—and critical illness insurance, too.

In addition to covering core conditions like cancer and stroke, many cover conditions like multiple sclerosis, organ transplants, Alzheimer’s disease, and Parkinson’s disease.

The first step, of course, is to find out what coverages are available in your area—and determine if they’re a good fit for you.

This information above is not intended to be nor should be construed as medical advice or a substitute for your doctor’s care. You should consult with an appropriate health care professional to determine what may be right for you.

This is not an offer or solicitation to sell insurance products. The information above is intended to provide general information and constitutes a summary of the different product benefits. It is not a contract or agreement. The terms of insurance coverages in the plans may vary by jurisdiction. All products are subject to exclusions and other applicable terms and conditions.

The Phia Group Notice of Data Security Incident