11 Apr 2024

Rediscovering Critical Illness Insurance: Why Its Time Has Come

If you follow industry trends, you may have noticed that demand for critical illness insurance is growing. That’s understandable, because critical illness coverage is valuable, affordable protection that calms a well-founded fear: the fear of life-threatening illnesses and all the havoc they wreak.

While some insurance carriers are new to this market, member companies of PALIG have provided critical illness insurance for many years. This gives you an advantage—because you already have a proven, competitive product to offer your prospects and clients.

It’s time to bring this overlooked gem into the spotlight. Let’s consider why critical illness insurance deserves more attention—and how you can sell more of it.

What Is Critical Illness Insurance?

As you know, critical illness coverage is a type of life and health insurance that provides a lump sum payment upon diagnosis of a serious illness or medical condition covered under the policy.

Unlike health insurance, which pays for incurred medical expenses—and often pays healthcare providers directly—critical illness benefits are paid to policyholders, who may use those funds however they choose.

Compared to life and health insurance, critical illness is a relatively new product. Interestingly, it was invented by a cardiac surgeon, Dr. Marius Barnard, in 1983.

A member of the team that performed the first human heart transplant, Dr. Barnard witnessed the financial toll of critical illness on patients and families. That first policy covered four conditions: cancer, stroke, heart attack and coronary bypass surgery.

Over the last 40 years, critical illness insurance has grown in scope and popularity—a trend that’s predicted to grow. If you haven’t already, now’s the time to start actively promoting this product.

Growth Opportunities: A Market That’s Poised to Expand

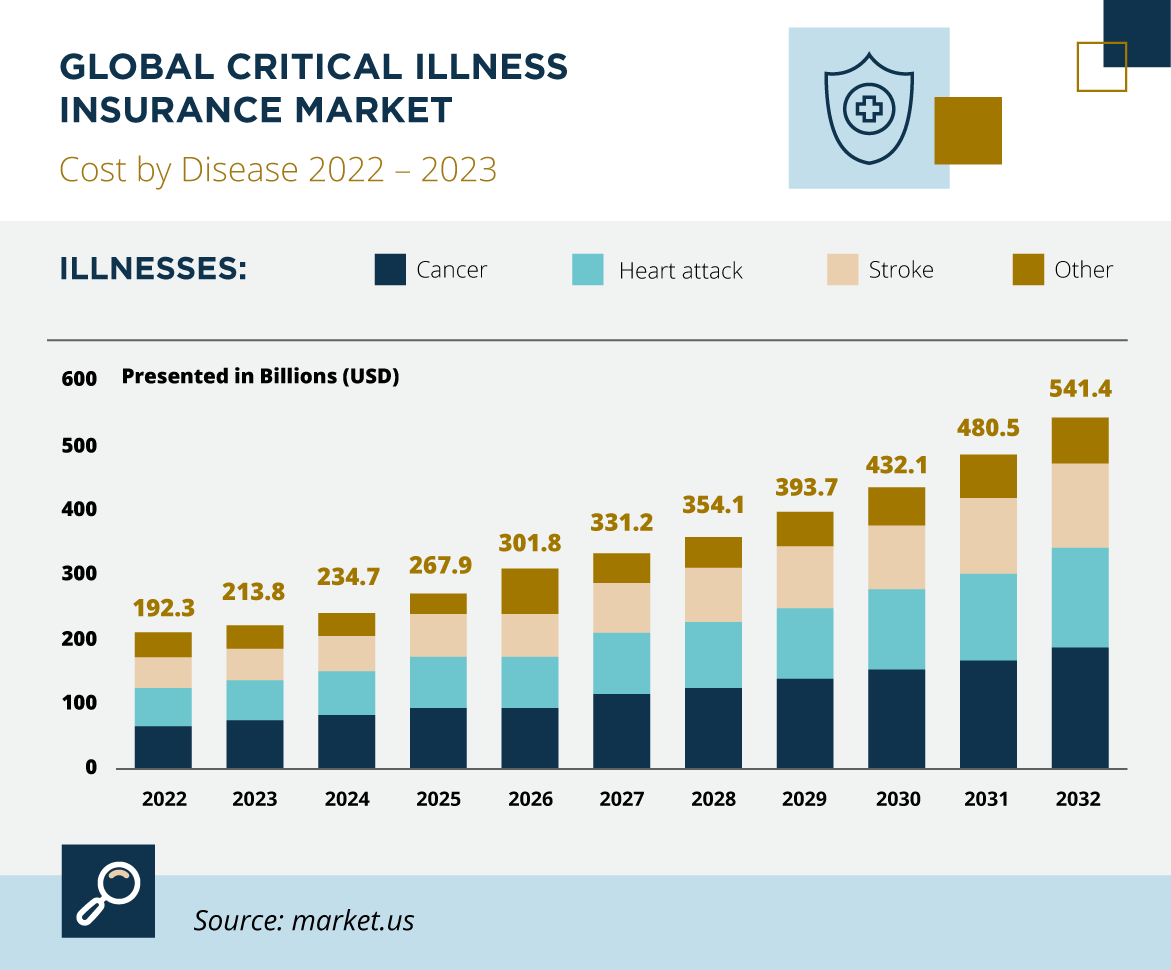

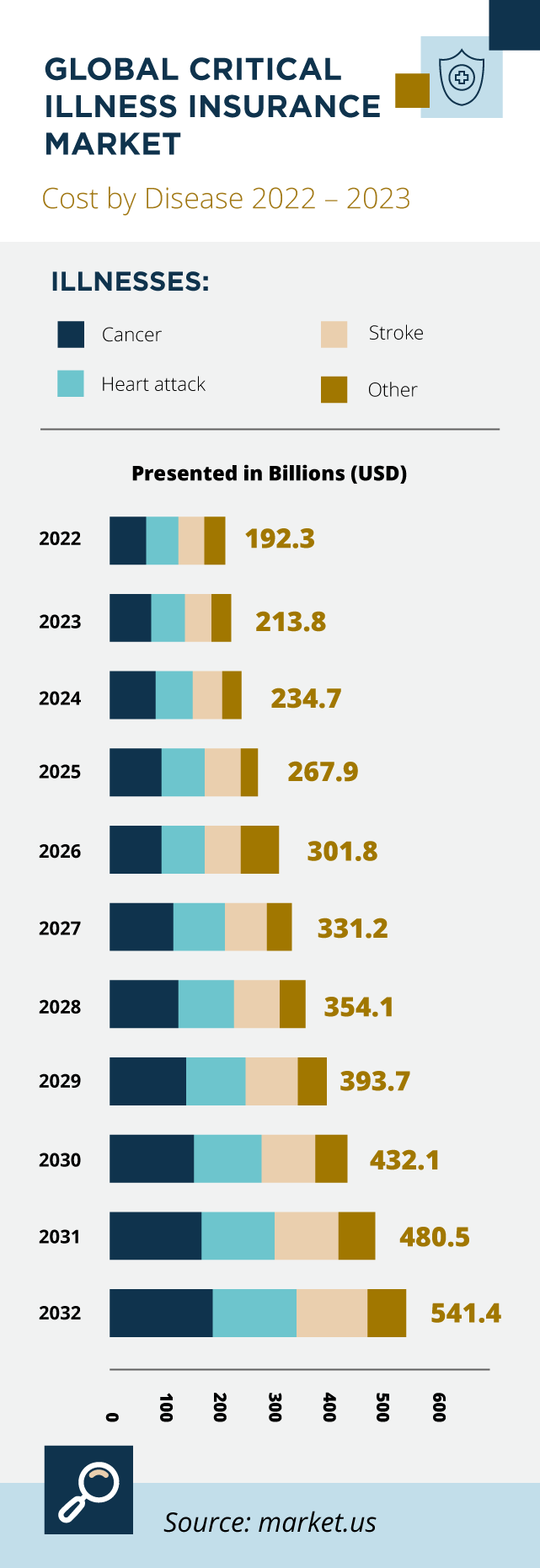

The global critical illness insurance market was valued at $192.3 billion in 2022 and is expected to grow to $541.4 billion in 2032, at a compound annual growth rate (CAGR) of 11.2%.

What’s driving this impressive growth? A number of factors, starting with the increased prevalence of critical illnesses like cancer and heart attacks, especially in younger adults. Increasing healthcare costs are a contributing factor, along with our renewed focus on health and family—an enduring aftereffect of the pandemic.

As a result, more individuals are becoming receptive to this product—once they learn about it. The first step is to raise awareness, and that’s where you come in.

Why Pan-American Life’s Critical Illness Product Is Competitive

While member companies of PALIG have competed successfully in this market for some time, we’ve recently renewed our commitment to this product.

Unlike some other policies in the market, critical illness policies offered by member companies of PALIG are already quite broad. While specifics vary by country, most policies not only cover cancer, stroke, heart attack and renal failure, but a range of conditions such as multiple sclerosis, organ transplants, Alzheimer’s disease, Parkinson’s disease, motor neuron disease and more.

In addition, they offer consumers a range of coverage amounts to choose from. In some countries, policyholders can add a child rider that extends coverage to their children.

Pair that with strong industry ratings issued to Pan-American Life Insurance Company and Pan-American Assurance Company, and you have a compelling story to tell.

How to Position Critical Illness Insurance

There are multiple ways to position critical illness insurance, depending on your client’s situation.

For example, many producers frame critical illness as a supplement to health insurance, especially for families with limited or high-deductible health plans.

In addition, critical illness insurance can serve as an affordable alternative to disability insurance for those who are ineligible for it, such as self-employed workers and stay-at-home parents.

Finally, it is especially appealing to individuals with a family history of certain health conditions, such as heart attacks and Alzheimer’s disease, who want to protect themselves against their increased risk.

Key Talking Points for Producers

For many consumers, the most compelling advantage of critical illness insurance is its flexibility—the fact that they can use their benefits however they wish.

That’s an important talking point to share with clients: that they can use their benefits to pay medical bills not covered by their health insurance or to replace lost income, so they can continue to provide for their families.

Another key talking point: unlike health insurance, with critical illness, there are no deductibles, copays, or coinsurance to satisfy. And unlike disability income insurance, there is no waiting period. Critical illness insurance benefits allow insureds to immediately start focusing on their health and treatment—knowing their family and finances are protected.

Anyone who has ever witnessed a loved one grapple with a critical illness knows how difficult such a diagnosis can be. For all of these people—and at some point, that includes most of us—critical illness insurance is an affordable way to plan ahead and provide peace of mind.

For all these reasons, now’s the time to start promoting critical illness. If you’d like more information specific to your market, please contact your PALIG sales team. We’re here to help!

This is not an offer or solicitation to sell insurance products. The information above is intended to provide general information and constitutes a summary of the different product benefits. It is not a contract or agreement. Some products may not be available in every jurisdiction where Pan-American Life is licensed to do business. All products are subject to exclusions and other applicate terms and conditions.