Español

Saint Lucia

Life Insurance / Insurance Solutions

Mistakes to Avoid When Buying Life Insurance

October 31, 2024

Estimated Reading Time: 4m

Getty Images

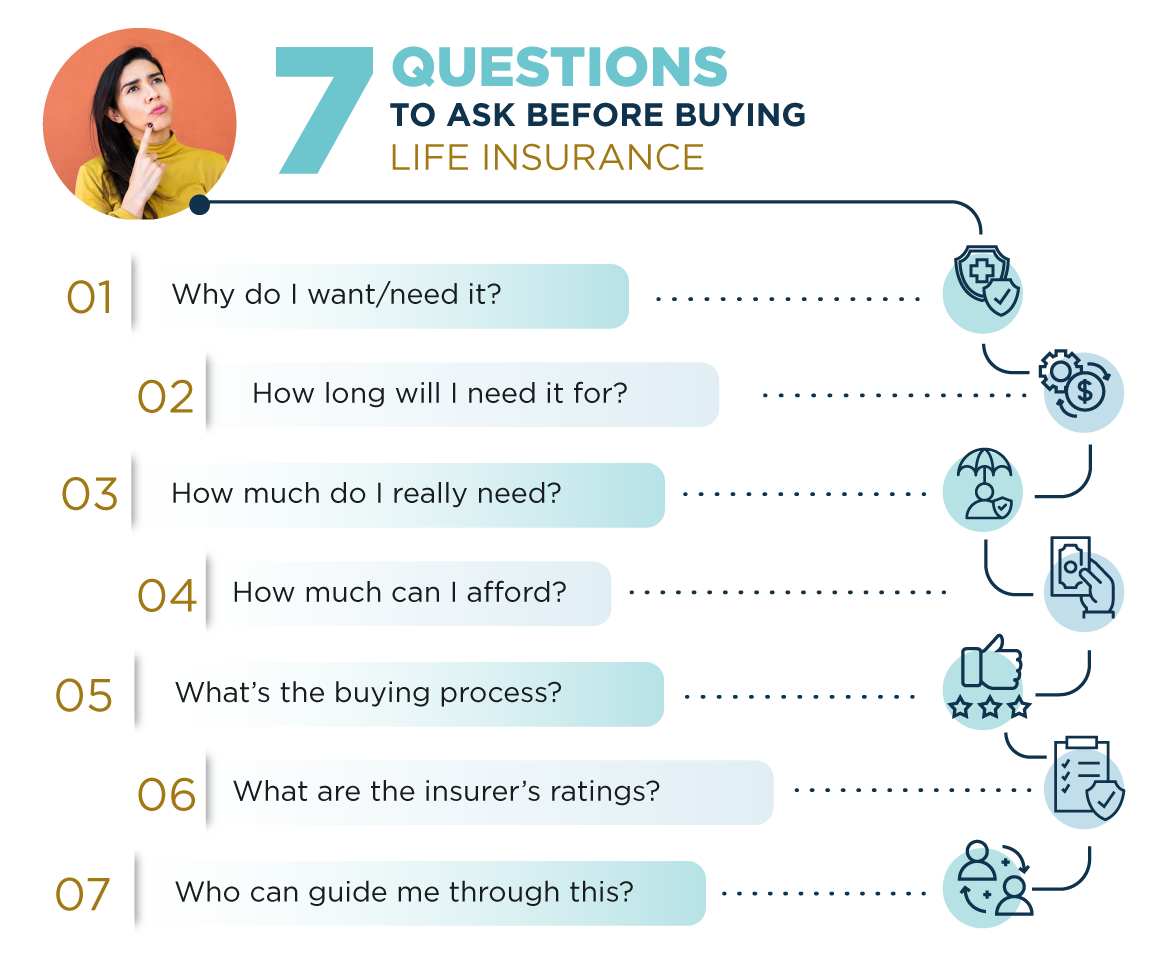

So, you’re ready to purchase life insurance—and you want to make an informed decision. That’s wise, especially if you’re new at this.

Chances are, you already know why you want to purchase life insurance, and that’s a terrific place to start. That said, in order to choose the right policy for you, take care to avoid these common mistakes.

1. Not Buying Enough Coverage

Many people underestimate how much coverage they need, but you can avoid this pitfall by focusing on your why.

For example, if your goal is to make sure your family is provided for if something happened to you, think about what that fully entails: replacing your lost income for however many years, paying the mortgage, covering your kids’ future college tuition, etc.

In other words: don’t just pick a nice, round number; calculate what it is your family will need. If that sounds daunting, remember: an experienced insurance agent can help you figure this out.

2. Choosing the Wrong Type of Policy

There are several types of life insurance, including term, whole life, universal life, amongst others. Choosing the right type depends on your why, too.

For example, if your goal concerns a defined period of time—say, until the kids are grown—then term life may be a great option. But if it involves estate planning, a whole or universal life policy is likely a better choice.

To learn more about types of life insurance,

3. Waiting Too Long to Buy

With life insurance, time is not on your side. The older you are, the higher your rates will be. And should your health decline, you may end up paying even more—or struggle to get approved for insurance.

And every day that you wait is a day unprotected. If you have a family to provide for or a future to plan for, it doesn’t make sense to wait.

For more about the right time to buy,

4. Not Choosing a Financially Strong Insurer

Not all life insurance companies are equally strong and stable. A company with shaky finances may be unable to meet its policyholder obligations. Although the industry is closely regulated, it’s in your interest to find out:

- How long an insurer has been in business

- How long it’s been in the life insurance market

- Its reputation and industry standing

- Its financial ratings

Independent rating agencies like AM Best and Fitch Ratings perform extensive research to gauge insurers’ financial strength, reviewing balance sheets, operating performance and more. These ratings matter; it’s never in your interest to align with a poorly‑rated company.

For more about PALIG’s 110‑year history and top financial ratings,

5. Committing to Premiums You Can’t Afford

Yes, you want to buy enough life insurance policy to meet your objectives, but that only works if you can afford the premiums. If you don’t pay your premiums, your policy will lapse.

So, before you commit, confirm that the premiums fit within your current budget and long‑term financial plan. It’s better to buy a modest policy that you can afford than risk losing a larger one because you were too ambitious. You can always buy more coverage later.

6. Fudging the Truth on Your Application

When applying for life insurance, honesty is crucial. Omitting a health condition or downplaying a lifestyle risk—like smoking—puts your coverage at risk.

If an insurance company finds that you provided false information, it may have grounds to deny your beneficiary’s claim.

Many insurers require some type of physical upon application anyway (your agent will advise you what’s required). Be honest about your health, lifestyle and medical history to protect your coverage.

7. Failing to Seek Professional Advice

There are many things that consumers can handle just fine on their own, but for most people, purchasing life insurance isn’t one of them.

As the saying goes, you don’t know what you don’t know—and life insurance can be detailed and technical.

When you work with an experienced insurance agent, they bridge the gap for you. They’ll explain your choices, help you understand your policy terms—and ensure that you get the right policy for your situation.

Interested in finding such a professional? PALIG agents are highly trained and service oriented—and they’ll help you avoid all the common mistakes. For more information, or to contact a local agent,